Indiana County Income Tax Rates 2024. Indiana state income tax tables in 2024. How to calculate 2024 indiana state income tax by using state income tax table.

The annual salary calculator is updated with the latest income tax rates in indiana for 2024 and is a great calculator for working out your income tax and salary after tax based on a. 0.65% tax rate for nonresidents who work in tippecanoe county.

Prepared By The Indiana Department Of Local Government Finance March 5, 2024 Page 2 Of 55.

The income tax rates and personal allowances in indiana are updated annually with new tax tables published for resident and non.

County Tax Rates By Year.

The indiana individual adjusted gross income tax rate for 2023 is 3.15% and will adjust in 2024 to 3.05%.

The Indiana Department Of Revenue (Dor) Released Departmental Notice #1, How To Compute Withholding For State And County Income Tax, Reflecting Changes In Local.

Images References :

Source: www.mywabashvalley.com

Source: www.mywabashvalley.com

tax increase begins October 1 in several counties, 2024 indiana local income taxes. 0.65% tax rate for nonresidents who work in tippecanoe county.

Source: crewlasopa822.weebly.com

Source: crewlasopa822.weebly.com

Hamilton County Indiana Property Tax crewlasopa, Indiana department of revenue announces that five counties have increased their income tax rates effective october 1, 2022. 2) an increase to 0.0265 from 0.023 for montgomery county;

Source: taxrelief.org

Source: taxrelief.org

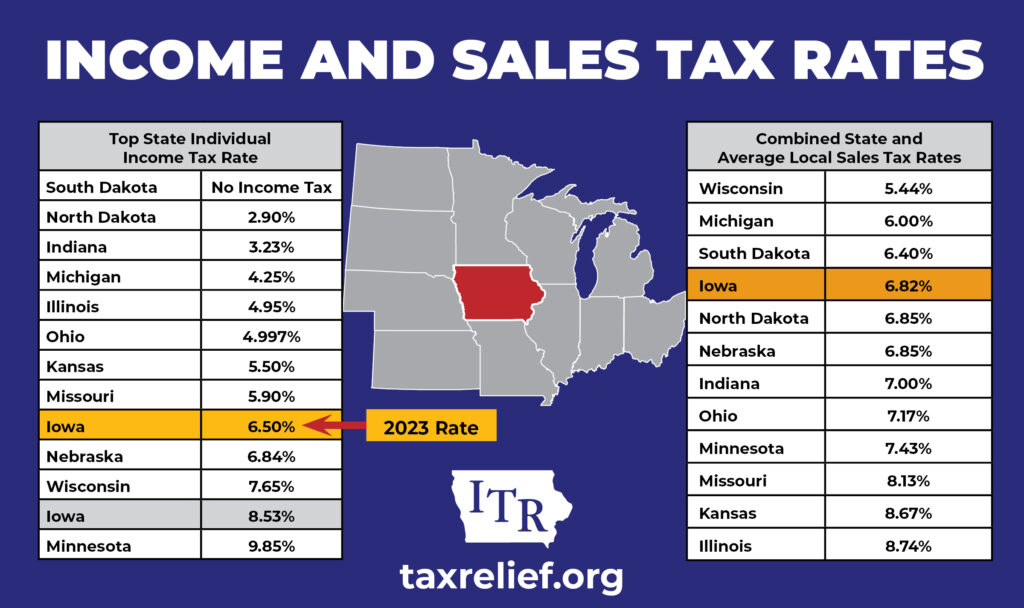

Midwest State and Sales Tax Rates Iowans for Tax Relief, Local county income tax report. Find your pretax deductions, including 401k, flexible account.

Source: www.countyforms.com

Source: www.countyforms.com

Indiana County Tax Form, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. For tax years beginning after december 31, 2024,.

Source: www.countyforms.com

Source: www.countyforms.com

Form It 40 County Tax Schedule For Indiana Residents Form Printable, The annual salary calculator is updated with the latest income tax rates in indiana for 2024 and is a great calculator for working out your income tax and salary after tax based on a. We have information on the local income tax rates in 91 localities in indiana.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 1) an increase to 0.0215 from 0.0195 for greene county; Montgomery county courthouse 100 e main st., crawfordsville, in 47933 county government center 1580 constitution row, crawfordsville, 47933 get.

Source: events.in.gov

Source: events.in.gov

Individual Tax Rates to Rise in Three Indiana Counties Effective, Effective january 1, the following counties have income tax rate increases: Wed, march 27, 2024, 5:08 am pdt · 6 min read.

Source: www.insideindianabusiness.com

Source: www.insideindianabusiness.com

Tax Rates Increasing for Two Indiana Counties Inside INdiana Business, 's administration and weighed in on whether. The indiana individual adjusted gross income tax rate for 2023 is 3.15% and will adjust in 2024 to 3.05%.

Source: events.in.gov

Source: events.in.gov

Individual Tax Rates Change in Six Counties State of Indiana, Indiana state income tax tables in 2024. County tax rates by year.

Source: accupay.com

Source: accupay.com

Taxes Archives AccuPay Payroll and Tax Services Indianapolis, However, many counties charge an additional income tax. Indiana republican candidates rated gov.

Indiana State Income Tax Tables In 2024.

Hb 1002, enacted in 2022, lowered the personal income tax rate from 3.23% to 3.15% for tax years 2023 and 2024.

Since 2017, The First Year Under The.

The indiana department of revenue (dor) issued a notice, effective jan.